How To Register A Nonprofit In Dc

How to Start a Nonprofit in DC

In that location are many good reasons to start a nonprofit in DC, merely knowing the beginning few steps to have can be challenging.

We'll help you start a nonprofit and complete your 501(c)(iii) application in our How to Showtime a Nonprofit in DC guide beneath.

Or, simply use a professional service:

Incfile (Starting at $0 + Country Fees)

Starting a 501(c)(three) Nonprofit in DC is Piece of cake

To start a 501(c)(3) revenue enhancement-exempt nonprofit organization in DC, you must showtime starting time a DC nonprofit according to the rules of the state and and so apply for 501(c)(3) status with the IRS.

Learn more about 501(c)(3) eligibility in our What is a 501(c)(3) guide.

To start a 501(c)(3) nonprofit corporation in Washington D.C. y'all must:

Step 1: Name Your Washington D.C. Nonprofit

Footstep 2: Cull Your Registered Agent

Pace 3: Select Your Board Members & Officers

Pace 4: Adopt Bylaws & Conflict of Interest Policy

Step 5: File the Articles of Incorporation

Stride 6: Go an EIN

Step 7: Use for 501(c)(3)

Step 1: Proper noun Your Washington D.C. Nonprofit

Choosing a proper name for your organization is the kickoff and most important step in starting your nonprofit corporation. Be certain to cull a name that complies with Washington D.C. naming requirements and is hands searchable by potential members and donors.

To larn more, read our How to Name a Nonprofit in Washington D.C. guide.

ane. Follow the naming guidelines:

The name of your organization must include:

- "corporation", "incorporated", "company", or "limited", or the abridgement "Corp.", "Inc.", "Co.", or "Ltd.", or words or abbreviations of similar import in some other language

Read the official guidelines for the consummate rules on naming a Washington D.C. based organization.

ii. Is the name available in Washington D.C.?Make sure the name you lot want isn't already taken by doing a name search on Washington D.C.'s website.

3. Is the URL bachelor? We recommend that you check to see if your business name is bachelor as a web domain. Even if you don't program to brand a business organisation website today, you may desire to buy the URL in order to prevent others from acquiring information technology.

Find a Domain Now

Registered your domain proper noun? Side by side, we advise choosing a business phone organisation to help your nonprofit build authority and trust. Phone.com is our first pick due to its affordability and height-notch customer back up. Try Phone.com today.

Step ii: Cull a Registered Amanuensis in Washington D.C.

Your nonprofit is required to nominate a Washington D.C. registered agent for your organization.

What is a Registered Agent? A registered agent is an private or business organization entity responsible for receiving of import legal documents on behalf of your business. Think of your registered agent as your business organization' point of contact with the land.

Who can be a Registered Agent? A registered agent must exist a resident of Washington D.C. or a corporation, such equally a registered amanuensis service, authorized to transact business in Washington D.C. Yous may elect an individual inside the company including yourself.

Step 3: Select your Directors & Officers

The directors of an organization come together to form a board of directors. This lath of directors is responsible for overseeing the operations of the nonprofit.

The president, secretarial assistant, and other members of nonprofit who have individual responsibilities and authorities are known equally officers.

The organization structure of your nonprofit in Washington D.C. MUST include:

- At least 3 directors not related to each other

- One officer focused on the direction of the organization

- One officer focused on the fiscal affairs of the organization

To learn more about electing a Washington D.C. nonprofit board of directors, read our full guide.

Step iv: Adopt Bylaws & Conflict of Interest Policy

To exist eligible to apply for 501(c)(3) status, your nonprofit is required to have the following ii documents:

- Bylaws

- Conflict of interest policy.

What are Bylaws? Bylaws are the rules outlining the operating procedures of the nonprofit.

What is a Disharmonize of Interest Policy? A Conflict of Interest Policy is the collection of rules put in place to ensure that any decisions made by the board of directors or the officers benefits the nonprofit and not individual members.

Note: The bylaws and conflict of interest policy must be adopted past the nonprofit during its first organizational meeting where the directors and officers are officially appointed.

Pace 5: File the Washington D.C. Articles of Incorporation

To register your nonprofit, you will need to file the Washington D.C. Articles of Incorporation.

To ensure that your nonprofit is eligible to apply for 501(c)(3) status, in the Articles of Incorporation you must explicitly state the following:

1. Purpose:

In guild to authorize for 501(c)(iii) status, the organization'due south purpose must explicitly be express to one or more of the following:

Charitable, Religious, Scientific, Educational, Literary, Fostering national/international amateur sports competition, Preventing cruelty to animals/children, testing for public safety

2. Dissolution:

You must explicitly state what the avails of the organisation will be used for, and what will happen to the assets if the organization is dissolved.

To exist eligible for 501(c)(3) condition, the assets of your organization must merely always be used for purposes approved nether section 501(c)(3).

Department 5 of this sample IRS certificate provides an case of these provisions required for 501(c)(3) eligibility.

Option 1: File with Washington D.C.'s online services

File Online

- OR -

Selection ii: File past mail or in-person.

Download Course

Commune Filing Cost: $80

Mail to:

Department of Consumer and Regulatory Affairs

Corporations Division

P.O. Box 92300

Washington, DC 20090

Step vi: Become an EIN

What is an EIN? The Employer Identification Number (EIN), or Federal Taxation Identification Number, is used to identify a business entity such as your nonprofit corporation. It is essentially a social security number for your organization.

Why do I need an EIN? An EIN is required for the following:

- To open a business organization bank account for the company

- For Federal and State revenue enhancement purposes

- To hire employees for the visitor

How exercise I go an EIN? An EIN is obtained from the IRS (complimentary of charge) by the business owner after forming the company. This tin exist done online or by mail service. Check out our EIN Lookup guide for more information.

Step 7: Employ for 501(c)(3) Status

Earlier a nonprofit can employ for 501(c)(3) status it must,

- Elect at least 3 directors not related to each other

- File the Articles of Incorporation with the required provisions (As covered in Step 5)

- Prefer the bylaws and conflict of interest policy

- Have an EIN number

One time these four weather condition have been met your nonprofit can apply for 501(c)(iii) revenue enhancement-exempt status by filing Class-1023 online.

If your application is canonical, the IRS will send you a determination letter stating that your organization is exempt from federal taxes under department 501(c)(3).

FAQ: Starting Your Nonprofit

When should an organization apply for federal tax exemption?

Form 1023 must be filed within 27 months from the end of the commencement month your organization was created.

How long will it take for the IRS to procedure Grade 1023/1023-EZ?

Shortly after sending your awarding you should receive an acknowledgment of receipt of your application.

If your application is simple and complete, IRS will ship your determination letter within 180 days for Form 1023

If you have not heard from them past that time yous can telephone call (877) 829-5500 to ask near your application.

Find out which nonprofit formation service is the best for you lot in our review on Startup Savant.

Of import Steps After Forming a Nonprofit

Business Banking

1. Opening a business banking concern business relationship:

- Separates your personal avails from your company'south avails, which is necessary for personal asset protection.

- Makes accounting and tax filing easier.

To open a banking company business relationship for your nonprofit corporation yous will typically need the following:

- The EIN for the nonprofit

- A re-create of the nonprofit's bylaws

- A re-create of the Articles of Incorporation

Read our Best Small Business Banks review to detect the right bank for your nonprofit's needs.

2. Getting a concern credit card:

- Helps you separate personal and concern expenses.

- Builds your company's credit history, which can be useful to enhance uppercase subsequently on.

3. Hiring a business accountant:

- Prevents your business from overpaying on taxes while helping you avoid penalties, fines, and other plush tax errors

- Makes accounting and payroll easier, leaving you with more than time to focus on your growing business

- Helps finer manage your business funding and discover areas of unforeseen loss or extra profit

For more business concern accounting tools, read our guide to the best business organization accounting software.

Become Insurance

Business insurance helps you manage risks and focus on growing your concern.

The most common types of business insurance are:

- General Liability Insurance: A broad insurance policy that protects your business from lawsuits. About small businesses get full general liability insurance.

- Professional Liability Insurance: A business concern insurance for professional service providers (consultants, accountants, etc.) that covers against claims of malpractice and other business errors.

- Workers' Bounty Insurance: A blazon of insurance that provides coverage for employees' chore-related illnesses, injuries, or deaths.

Recommended:Inform your employees nearly their rights and stay compliant by posting labor law posters in your workplace.

Build a Business organization Website

Creating a website is a big stride in legitimizing your business. Equally a nonprofit, your website volition exist the principal way to share your organisation'due south mission and story to supporters. Your website should be a bully resource for anyone interested in your nonprofit's upcoming events, goals, and news to help advance your cause.

Some may fright that creating a business organisation website is out of their achieve because they don't have any website-building experience. While this may accept been a reasonable fear back in 2015, spider web technology has seen huge advancements in the past few years that makes the lives of small business owners much simpler.

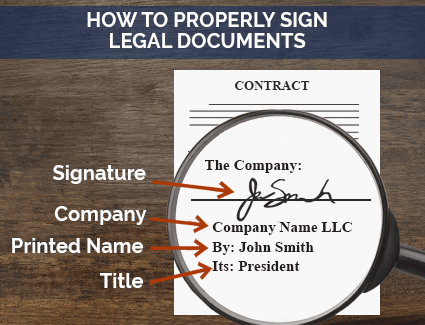

Properly Sign Legal Documents

Improperly signing a certificate as yourself and not as a representative of the business can exit yous open to personal liability.

When signing legal documents on behalf of your nonprofit, you could follow this formula to avert problems:

- Formal name of your organization

- Your signature

- Your name

- Your position in the business as its authorized representative

Come across the prototype below for an example:

This ensures that you lot are signing on behalf of your nonprofit and non as yourself.

Washington D.C. Quick Links

- IRS - Information for Charities & Nonprofits

- IRS - Required Provisions for Organizing Documents

- IRS - 990 Series for Tax-Exempt Organizations

- IRS - Applying for Tax-Exempt Status

- IRS - 501(c)(3) Compliance Guide

- DC Role of Taxation and Revenue

- DC Business organisation Centre

Washington D.C. Business Resources

Have a Question? Leave a Annotate!

How To Register A Nonprofit In Dc,

Source: https://howtostartanllc.com/form-a-nonprofit/washington-dc-nonprofit

Posted by: mullanaforeg.blogspot.com

0 Response to "How To Register A Nonprofit In Dc"

Post a Comment